The US is one of the largest countries to remain behind on the transition toward EMV technology. Canada, on the other hand, adopted EMV just as it was starting to gain popularity. This adoption has significantly impacted fraud losses in Canada. A study done by the Canadian Bankers Association found that the total value of fraud transactions saw a decrease of over 54.56% from $245.4 million in 2008 to $111.5 million in 2013 (Canadian Bankers Association, 2015 p. 4). This is important to note since the United States is one of the few countries that still accept swipe payments. These are the most vulnerable to fraud since financial information can easily be copied from the magnetic strip. Card fraud is a huge issue across the world but credit card companies have started to fight it with new payment security technology.

Card Fraud Stats in the United States

According to a 2015 study by Barclays, the United States accounts for approximately 47% of worldwide card fraud. However, they only account for 24% of worldwide card volume. As of 2008, debit card fraud alone accounted for approximately $788 million in the USA. This is concerning for credit card companies as well as banks because of the huge losses they face. Some experts in the field attribute this incredibly high rate of fraudulent activity to the slow process of EMV adoption.

Why they don’t switch over to EMV

One of the main sticking points for retailers in the United States is the cost of upgrading all their payment terminals to EMV certified units. In 2010 FirstData estimated the cost of upgrading all the payment terminals in the US to be approximately $8 billion. Merchants would swallow this cost, which is an incredibly difficult ask for small and medium businesses (FirstData, 2010).

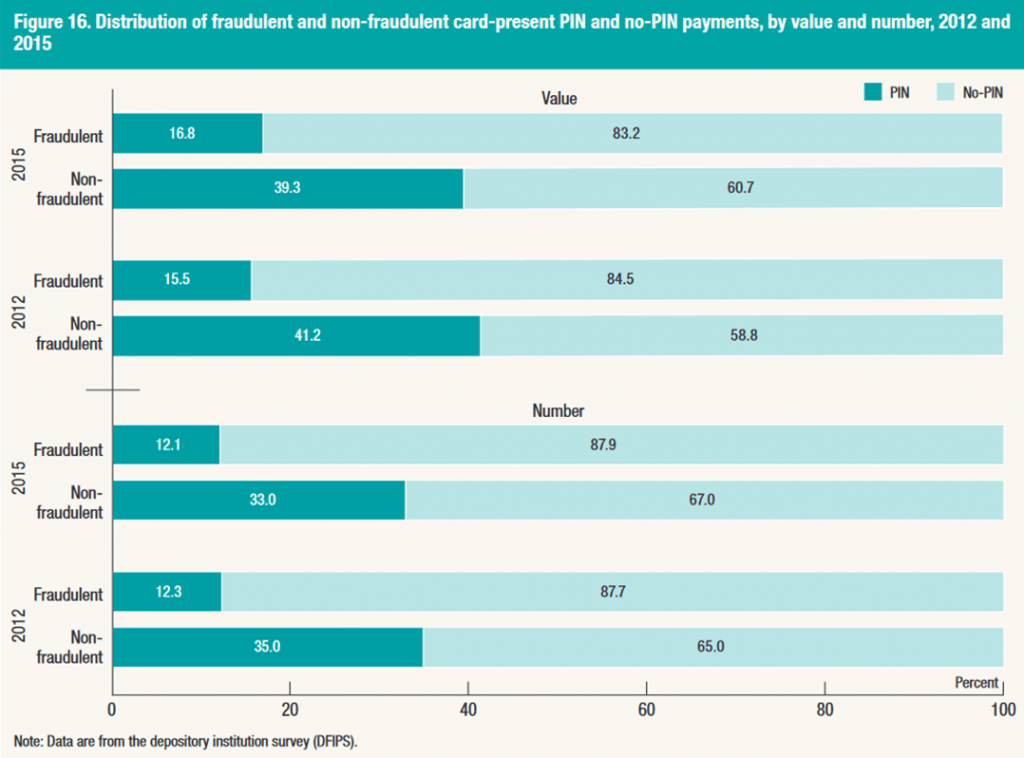

The same study determined that it would be at least a decade for the United States to implement EMV technology completely. However, in 2020, the USA is still very behind all other countries in their upgrade to EMV. When comparing data from 2012 and 2015, non-PIN payments accounts for the majority of all fraudulent activity in the US. This is yet another significant finding in the push toward chip & PIN security being implemented to prevent card fraud.

While in-person transaction fraud decreased significantly in both countries due to the implementation of varying degrees of EMV, fraud rates for customer-not-present transactions increased significantly. Online shopping and purchasing has made it possible for criminals to gather financial data through data breaches and phishing scams. It’s important that customers do their best to protect their financial data while card companies devise a strategy to deal with the new challenges. As EMV technology slowly saturates the market, card-present fraud will keep decreasing but card-not-present fraud will remain on an upward trend. That is, until credit companies enable more security features for online transactions.

Despite Canadian merchants being ahead of their US counterparts, some are still lagging behind on EMV technology. Many unattended operations still don’t have EMV payments. That’s why credit card companies have made it mandatory to make the change by 2022.

Wiz-Tec offers a wide variety of EMV certified and PCI compliant payment terminals.

1 thought on “Credit card fraud: Canada vs. USA”

Thank you for this; this was a awesome read